Have you ever noticed how paying for something online now feels almost too easy? One minute you’re buying a pair of shoes, and the next you’re being offered financing, insurance, or a rewards account without ever leaving the page. Honestly, it’s wild how normal this has become—and most people have no idea what’s happening behind the curtain. This quiet shift is the rise of embedded finance, and it’s changing the rules for companies that never thought of themselves as financial players.

If you’re a non-bank watching all of this unfold, it can feel both exciting and a little overwhelming. The possibilities are huge, but the learning curve is real. And truth be told, understanding what’s happening now could be the difference between leading your market… or scrambling to catch up later.

Why Embedded Finance Is Non-Banks’ Golden Opportunity

Ever notice how people get impatient the second an app forces them to open a new tab or re-enter information? We’ve all been there. That tiny moment of friction is exactly why embedded finance has exploded—and why non-banks suddenly have a chance to play in a space once reserved for traditional lenders and card issuers. Customers want everything in one place. And honestly, they reward the companies that give them that kind of simplicity.

Embedded finance isn’t just another tech trend. It’s a shift in how trust, convenience, and loyalty are built. And for non-banks, it’s the doorway to deeper customer relationships without rewriting your entire business model.

Changing Customer Expectations and Platform Models

Think about the last time you booked a flight or ordered takeout. You probably paid, insured, tracked, or financed something without ever noticing the financial rails underneath it. That’s the new baseline. Customers expect platforms to “just handle it,” whether it’s payments, short-term credit, or even opening an account.

For non-banks, this means your platform isn’t just a storefront or a service portal anymore. It’s a place where customers expect to complete their whole journey—no handoffs, no redirects, no confusion. And if you don’t offer that seamless flow, someone else probably will.

Here’s the real question: What would your customer choose if they could get everything done in one smooth, familiar place?

Market Size, Growth, and What Those Numbers Mean for Non-Banks

The market projections for embedded finance are huge—billions turning into trillions over the next few years. But numbers only matter when we understand what they actually mean. For non-banks, it means the race for customer attention is shifting away from “own the product” to “own the journey.”

Platforms that embed payments, lending, or insurance see higher conversion rates, longer retention, and more predictable revenue. It’s not magic—it’s just what happens when you remove friction and keep the value inside your ecosystem.

The opportunity isn’t about becoming the next fintech giant. It’s about capturing the value you’re already creating, instead of letting a bank or third-party walk away with it.

So ask yourself: If customers are already spending money on or through your platform, why shouldn’t more of that value stay with you?

How Non-Banks Can Become Financial Services Providers Without Becoming Banks

The good news? You don’t need a banking license to offer banking-style features anymore. Modern banking-as-a-service (BaaS) providers and fintech partners do the heavy lifting—compliance, licensing, risk, all the stuff that makes most non-bank leaders cringe.

Your job becomes simpler: design the experience, choose the right partners, and plug the financial tools into your platform in a way that feels natural. You stay focused on your customers and your brand, while your partners handle the regulated work behind the scenes.

Think of it like adding electricity to a house—you don’t build the power grid; you just connect to it. This is embedded finance in its most practical form.

And the honest truth? Companies that start small—one feature, one use case—usually move faster and learn quicker than those trying to reinvent their entire system at once.

What Embedded Finance Really Means for Non-Banks

If you’ve ever wished your customers could act faster—buy faster, sign up faster, or check out with zero drama—embedded finance is basically the answer you didn’t know you were waiting for. It lets non-banks bring financial tools straight into their platforms without making customers jump through hoops. And honestly, in a world where attention spans are shrinking by the hour, that matters more than we admit.

Embedded finance isn’t about becoming a bank. It’s about offering the right piece of the financial experience at the exact moment your customer needs it. That’s where the magic happens.

Definition and Core Components (Payments, Lending, Banking, Insurance)

Let’s skip the stiff definitions for a second. Picture this: a customer checks out on your platform, gets offered insurance with one tap, or chooses to “pay later” without opening a new window. No redirects. No abandoned carts. No customer frustration.

That’s embedded finance in its simplest form—payments, lending, banking, and even insurance woven quietly into your experience.

For non-banks, these tools aren’t there to turn you into a financial institution. They’re there to support the journey your customer is already on. Think of them as helpful sidekicks, popping up at the perfect moment.

And here’s a question worth asking: If you could remove the most annoying step in your customer’s buying flow, wouldn’t you do it?

Integration Models: Partner, White-Label, Full Insource

Most non-banks get stuck here, not because the options are confusing—but because no one explains them in normal language.

Partner model:

This is the “plug it in and let the experts handle the regulated stuff” route. You keep your brand; they handle the banking guts. It’s fast, low-risk, and great for companies testing the waters.

White-label model:

You want your branding everywhere? This is your path. You still rely on a licensed partner behind the scenes, but customers see you front and center. It feels seamless.

Full insource:

The “we’re building a fintech arm” model. More control, bigger rewards, but also more responsibility. Most companies work their way up to this instead of diving in on day one.

Choosing a model is a bit like choosing a house—rent, renovate, or build from scratch. The best pick is the one that fits your budget, skills, and timeline.

So be honest with yourself: Which one actually fits your team today, not the version of you three years from now?

Value Chain and Ecosystem Players: Platforms, Enablers, Regulated Entities

The embedded finance world is crowded, but in a good way. Everyone plays a different role, which makes it easier for non-banks to join without drowning in complexity.

Platforms (that’s you):

You own the customer relationship. You design the experience. You decide when and where financial features show up.

Enablers (BaaS providers, fintech partners):

These are the behind-the-scenes wizards. They provide the tech rails, APIs, risk tools, and the smooth connections you need to make the experience work.

Regulated entities (banks and licensed institutions):

They hold the licenses, handle compliance, and keep everything legally sound.

The simple version?

You create the magic moment.

Your enabler powers it.

Your regulated partner makes sure it’s allowed.

When those three work well together, customers barely notice—except that everything feels easier.

Business Models & Revenue Streams for Non-Banks

If you’ve ever wondered why some companies seem to grow faster without adding more products, embedded finance is a big part of the story. It quietly builds loyalty, boosts revenue, and creates moments that keep customers coming back. And honestly, for non-banks, the money isn’t just in the financial feature itself—it’s in the stronger relationship that comes with it.

The beauty of embedded finance is that it blends into what you already offer. No big pivots. No reinvention. Just smarter ways to capture value that’s already sitting on your platform.

Customer Experience and Lifetime Value Enhancements

Think about the last time a brand made your life easier—maybe a ride app that saved your payment details, or a marketplace that offered instant credit at checkout. You didn’t stop to analyze the feature. You just thought, “Wow, that was smooth.”

That tiny moment of ease sticks with customers. It makes them trust your platform a little more, and trust is the currency behind lifetime value. Embedded finance creates those “this just works” moments: faster checkouts, less friction, smarter recommendations, and even personalized offers.

When a customer doesn’t have to jump between apps, their loyalty quietly deepens. And deeper loyalty always shows up in the metrics that matter—repeat purchases, higher order values, and lower churn.

So here’s your question: What small friction in your customer journey could you remove—and how would that change their behavior?

Revenue Levers: Interchange, Interest/Fees, Data Monetization, Ecosystem Lock-In

Here’s where things get interesting. With embedded finance, revenue doesn’t come from a single stream. It comes from a mix of small but powerful levers that add up over time.

Interchange:

Every card swipe or digital payment has a tiny fee baked in. When you offer your own branded payment experience, a slice of that flows back to you.

Interest and service fees:

If you embed lending—or even a pay-later option—you can earn a share of the revenue your partner bank generates. It’s incremental but steady.

Data-driven insights:

You’re sitting on behavior data that traditional banks would kill for. With the right guardrails, this can help you offer smarter financing, more relevant upsells, or personalized perks.

Ecosystem lock-in:

This is the sneaky-but-powerful one. Once customers store money, earn rewards, or use your platform for payments, they’re far less likely to leave. It’s not just revenue—it’s defensibility.

And honestly, who wouldn’t want a business that becomes more valuable simply because customers don’t want to go anywhere else?

Cost, Risk, and Investment Considerations

Of course, embedded finance isn’t a “flip the switch and get rich” move. It comes with real considerations. You’ll need to think about integration costs, partner fees, compliance oversight, and the internal resources required to support new financial features.

The good news? You don’t carry the full burden. Your regulated partners absorb the heavy risks—licensing, fraud monitoring, underwriting—so you can focus on experience and strategy.

Still, non-banks need to budget realistically. Start small, test a use case, measure results, and scale from there. Treat it like building a new wing of your business, not like a weekend side project.

Ask yourself: What’s the minimum version of embedded finance that would make a meaningful difference for your customers? That’s where you start.

Sector Use Cases: Embedded Finance In Action

One of the easiest ways to understand embedded finance is to see it in motion. Not in theory, but in the small everyday moments where a customer thinks, “Oh, that was easier than I expected.”

Whether you’re selling sneakers, running a SaaS platform, or powering an entire supply chain, embedded finance slips into the background and makes your experience feel complete. And honestly, once you see how it works across different industries, it’s hard not to imagine what it could unlock in your own.

E-commerce & Marketplaces

If you’ve ever bought something online and breezed through checkout without even noticing the payment step, that’s embedded finance doing its job. Marketplaces lean on it heavily—instant payouts to sellers, branded payments, buy-now-pay-later options, built-in insurance, you name it.

For e-commerce brands, this isn’t just about making checkout smoother. It’s about keeping customers inside your ecosystem and giving them reasons to come back. A marketplace that offers instant seller financing or same-day payouts becomes more attractive than one that doesn’t.

And here’s the big question: If you could remove the single biggest friction point in your checkout flow, what would that do for your sales?

SaaS and Business Platforms (B2B)

B2B platforms are quietly becoming financial powerhouses—often without ever calling themselves “fintech.” Think about a software tool that helps small businesses manage invoices. Add embedded finance, and suddenly those businesses can get paid early, access working capital, or even extend credit to their own customers.

The magic here is timing. When a business is staring at an unpaid invoice or needs to purchase new equipment, the offer of financing right inside the SaaS platform feels like a lifeline—not a sales pitch.

If you’re running a B2B platform, ask yourself: What financial moment happens naturally in your workflow that you could support with one click?

Mobility, IoT & Subscription Businesses

Mobility apps—ridesharing, scooters, rentals—are practically built on embedded finance. Drivers get paid instantly. Riders buy insurance with a tap. Subscriptions renew automatically. And IoT-powered devices can trigger payments on their own.

Subscription businesses also benefit big-time. Think about a gym app offering membership financing or a device provider letting users lease hardware through in-app credit.

It’s all about making the experience feel continuous. No handoffs. No extra steps. No “Where did that screen just take me?” moments.

And really—when was the last time anyone enjoyed entering payment details more than once?

Supply-Chain & Vertical-Industry Platforms

This is one of the biggest hidden opportunities. Supply-chain platforms handle massive transaction flows, but the financial tools supporting them are often outdated. Embedded finance changes that.

Imagine a distributor needing to restock inventory quickly. Instead of chasing their bank for credit, a financing option pops up right inside the supply-chain portal. Or think of a freight platform offering cargo insurance at checkout, instead of forcing logistics teams to hunt for it somewhere else.

Vertical-industry platforms—from agriculture to construction—are starting to realize they can become financial hubs simply by meeting customers where they already work.

If you’re in a specialized industry, consider this: What’s one financial bottleneck your users face every week that you could solve inside your platform?

Technical & Operational Readiness: What Non-Banks Must Build

There’s a moment every company hits when they decide to step into embedded finance. It’s that mix of excitement—because the potential is huge—and a tiny pang of “Wow, this is going to take some real work.” And that’s okay. The companies that win aren’t the ones with the fanciest tech; they’re the ones that prepare intentionally.

Think of this stage as laying the foundation for a house you’ll keep adding rooms to. It doesn’t have to be perfect on day one—but it does have to be solid, flexible, and ready to grow.

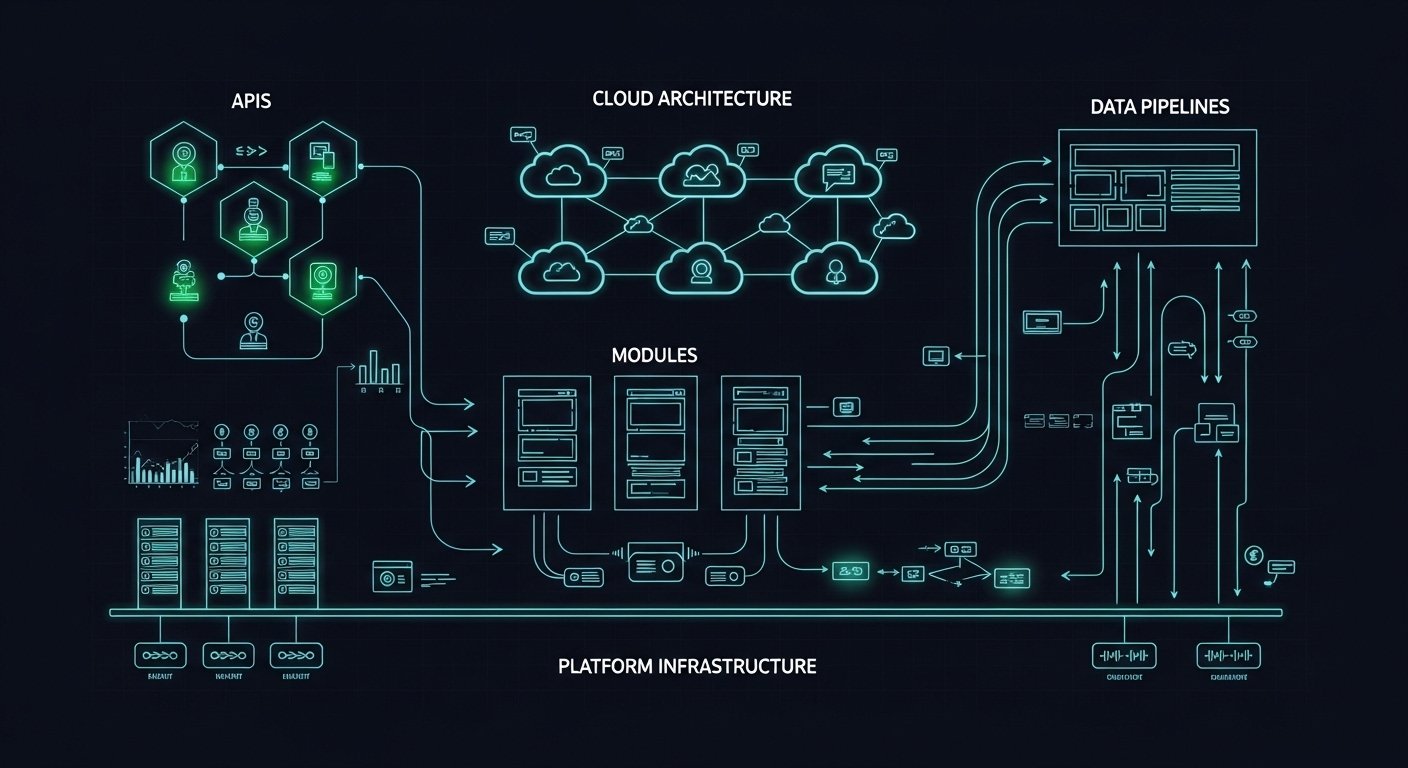

Core Infrastructure: APIs, Data, Cloud, Modular Design

Every great embedded finance experience starts behind the scenes. And honestly, it’s less glamorous than people think. You’re making sure your platform can talk to partners, handle secure data flows, and plug in new financial features without everything breaking.

APIs become your connectors. Cloud infrastructure keeps things fast and scalable. A modular design lets you roll out one feature at a time instead of ripping your whole system apart.

Picture a customer checking out, applying for credit, or receiving payouts—all within your platform. For that to feel instant and effortless on the outside, your backend needs to be calm, organized, and well-structured on the inside.

So here’s the question: If you plugged in a new financial feature tomorrow, would your systems welcome it—or freak out?

Talent and Organisation: From Platform Team to Fintech Mindset

This part often surprises non-banks the most. You don’t need hundreds of fintech experts. But you do need a team that thinks differently—curious, cross-functional, and comfortable shaping financial experiences.

Your designers need to understand new customer journeys. Your product team must think like experience architects. Your engineers need stronger observability and security instincts. And leadership has to embrace a fintech mindset, not a “let’s just bolt on a feature” mindset.

The shift is cultural as much as technical. Teams start asking new questions:

“Where should finance show up in the journey?”

“Who owns the customer risk?”

“What happens if something fails at 2 a.m.?”

And honestly, that’s when you know you’re becoming ready.

So ask yourself: Is your organization treating embedded finance like a feature… or a capability?

Data, Analytics and Underwriting: Turning Platform Data into Financial Services

Here’s where non-banks often underestimate their strength. You already sit on valuable behavioral data—purchase patterns, engagement signals, seller performance, operational trends. Traditional banks would kill for this kind of insight.

With embedded finance, this data becomes the engine behind smarter decisions:

-

Who qualifies for working capital

-

Which customers get personalized payment options

-

When to nudge a business toward financing inventory

-

How to detect early risk signals

You’re not becoming a credit bureau—you’re simply using your unique data to support financial moments inside your platform.

And the real question becomes: What signals do you already have that could make financial experiences safer and more tailored?

Integration-Model Decision Factors (In-House vs Enabler vs Regulated Partner)

This decision shapes everything—from speed to cost to compliance responsibilities. And truth be told, there’s no one “right” model. There’s only what fits your maturity, budget, and ambition.

In-house:

Maximum control, deeper margins, slower to launch. Works if you’re building a long-term fintech arm.

Enabler model:

Fastest time to market. Great for testing, learning, and launching with fewer internal demands. Most non-banks start here.

Regulated partner model:

You front the experience; they handle licensing, risk, KYC/AML, and compliance oversight. Perfect middle ground for companies ready to scale.

Think of it like choosing how to rebuild your kitchen—you can DIY, hire a contractor, or go with a fully managed service. Each comes with different timelines and stress levels.

So, ask yourself: What matters more right now—speed, control, or reducing risk?

Regulatory, Risk & Compliance Landscape for Non-Banks

If there’s one part of embedded finance that makes teams pause, it’s this one. Regulations. Risks. Acronyms that sound scarier than they are. And honestly, that hesitation is fair—when money moves through your platform, you’re playing in a space with real rules and real responsibilities.

But here’s the good news: you’re not expected to become a bank or memorize entire rulebooks. You just need to understand the basics, choose strong partners, and build processes that protect both your customers and your brand.

Licensing, KYC/AML, Reporting Obligations

Let’s be real—this is the part that usually makes product teams want to run for the nearest exit. But it doesn’t have to be overwhelming. Non-banks rarely hold the actual banking license. Instead, they work with regulated entities that handle the heavy compliance work.

What you do need is alignment:

-

What customer information must be collected?

-

Who performs identity checks?

-

How fast do suspicious activities need reporting?

-

Where does responsibility split between you and your partner bank?

Think of it like hosting a dinner but not cooking the main dish—you still set the table, welcome guests, and make sure everything feels right.

So here’s your moment of honesty: If regulators asked how your KYC and AML processes work, could you explain it clearly?

Data Protection, Consumer Protection, Governance Frameworks

Customers trust platforms that handle their money with care. And in embedded finance, that trust is built through strong data and governance practices.

It means protecting personal data as if it were your own. It means clear disclosures, transparent terms, and making sure customers understand what they’re signing up for. And it means internal governance—who approves what, how decisions are made, and how you escalate when something looks off.

You don’t need a giant legal team to get this right. You just need consistency, documentation, and a culture that takes customer safety seriously.

Ask yourself: If something went wrong tomorrow, would your team know exactly what to do?

Risk Management: Credit, Fraud, Model Risk in Embedded Finance

The tricky part about embedding finance is that risks don’t disappear—they just shift. Credit risk shows up when offering financing. Fraud risk becomes more visible when you handle payments. Model risk appears when you automate decisions using data.

The key is building early detection and shared responsibility with your licensed partners. Many enablers provide fraud tools, underwriting models, and dashboards to help non-banks monitor risk in real time.

Think of risk management the same way you think of seatbelts—you hope you never need them, but you’re glad they’re there every time you start the car.

And here’s a simple question: Do you know which risks are yours—and which ones belong to your partner?

Global and Regional Regulatory Variations (EMEA, APAC, LatAm)

The moment your platform reaches international users, the rulebook changes. Europe focuses heavily on consent, transparency, and strong identity checks. APAC markets move fast but require alignment with local banking partners. LatAm is booming with innovation but still tightening its regulatory guardrails.

What this means for non-banks is simple: don’t assume one compliance framework fits everywhere. And don’t wait until launch week to ask questions.

If your platform is growing globally, you should wonder: Are we building for one region—or building something that can adapt anywhere?

Strategic Challenges & Competitive Risks for Non-Banks

Every big opportunity comes with a few “hold on a second” moments, and embedded finance is no exception. Non-banks are stepping into a world where the rewards are real—but so are the competitive pressures. And honestly, acknowledging those risks early doesn’t slow you down. It actually makes you stronger, because you’re building with your eyes open instead of rushing in blind.

Disintermediation Risk: Platforms Becoming Banks?

There’s a quiet fear many non-banks have but rarely say out loud: What if customers start seeing us as a bank instead of what we actually are?

When you embed payments, lending, or financial accounts, you suddenly sit closer to the money than ever before. That closeness is powerful—but it also means you’re taking on a role customers traditionally gave to banks.

The risk isn’t that you’ll become a bank. It’s that you could accidentally position yourself as one, which comes with expectations you never intended to meet. Clarity matters. Boundaries matter. And your communication has to make it clear who is doing what behind the scenes.

So here’s your gut-check question: Does your customer-facing messaging protect your brand—or blur your identity?

Incumbent Banks’ Responses and Partnership Strategies

Banks used to see embedded finance as a threat. Now, many see it as a partnership engine. They’re building BaaS models, plugging into platforms, and looking for non-banks who can help them reach customers they’d never attract on their own.

But here’s the twist: banks still move slower than most non-banks expect. They have layers of compliance, legacy systems, and internal politics that can stretch timelines. That doesn’t mean they’re bad partners—it just means you should choose with intention.

A good bank partner fits your speed. A great bank partner fits your vision.

Ask yourself: Are we choosing a partner because they’re available—or because they’re right for our roadmap?

Talent, Complexity and Execution Risk: Common Pitfalls

This is where many embedded finance projects stumble. Not because the idea was wrong—but because the execution became heavier than expected.

Common pitfalls include:

-

Assuming existing teams can “just take it on”

-

Underestimating compliance reviews

-

Treating financial features like simple add-ons

-

Not leaving enough time for alignment across product, engineering, and legal

You don’t need a giant fintech team. But you do need clarity on ownership, cross-functional squads, and leadership that understands this isn’t a weekend upgrade—it’s a capability shift.

And the real question becomes: Do you have the bandwidth to do this well, not just do it fast?

How to Measure Success: Metrics, KPIs and What to Watch

Success in embedded finance doesn’t show up overnight. It builds quietly through behavior—higher retention, better conversion, fewer drop-offs, more consistent engagement.

Key things non-banks should track:

-

Adoption rates: Who’s actually using the feature?

-

Activation flow friction: Where do customers hesitate or drop?

-

Revenue per user: Is the financial layer lifting customer value?

-

Partner performance: SLAs, uptime, response times, risk tolerance

-

Customer sentiment: Are people excited, confused, or cautious?

Metrics tell you what happened. Customer feedback tells you what to fix next.

Ask yourself: If someone asked how embedded finance is performing today, could you answer confidently—or would you be guessing?

Roadmap: How Non-Banks Should Launch Embedded Finance

Every successful embedded finance rollout starts the same way—with curiosity, a little nervous energy, and a team willing to explore something new. You don’t need to have every detail locked in. You just need a clear path, the right partners, and the patience to build one smart step at a time.

Think of this roadmap as the difference between guessing your way forward and walking with intention.

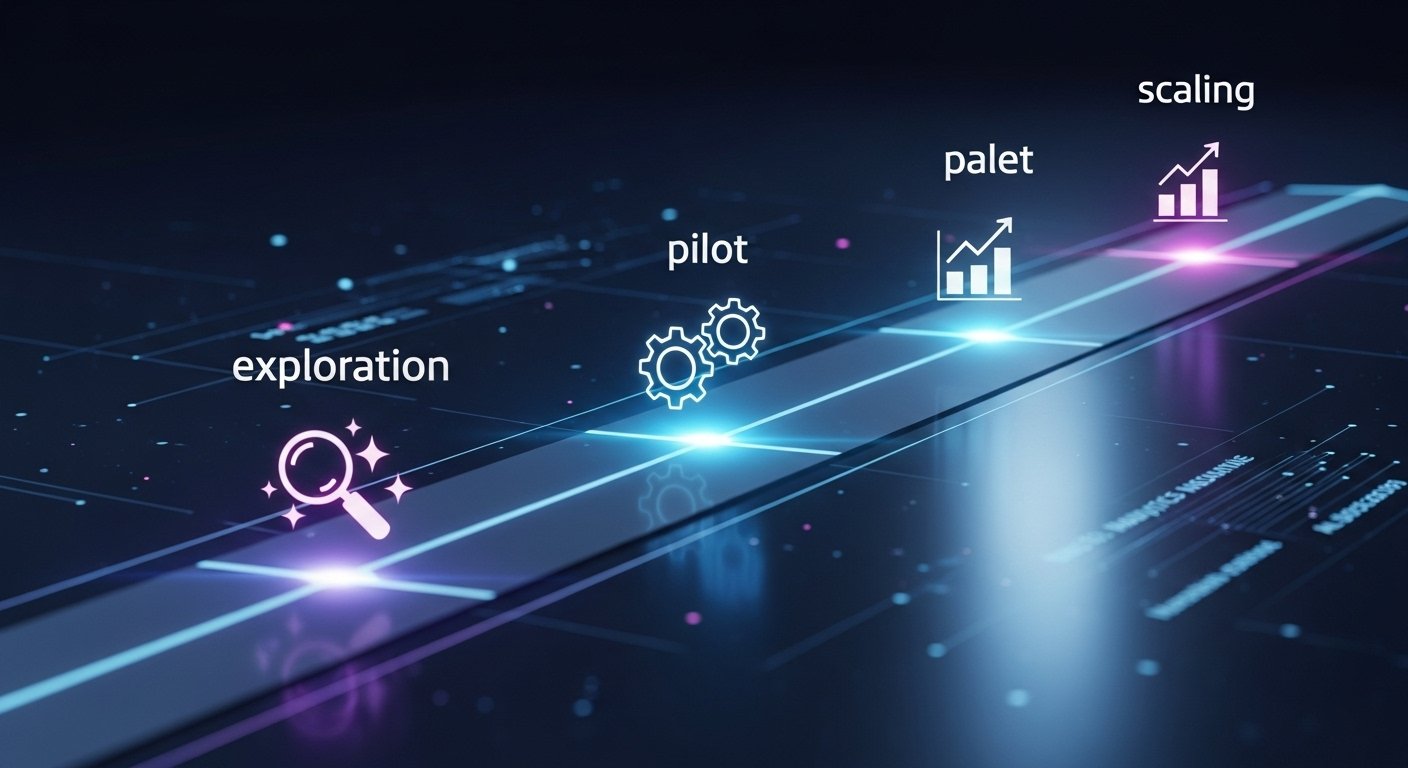

Phase 1 – Explore & Define Value Proposition

The first phase isn’t about tech at all—it’s about listening. What are your customers struggling with? Where do they hesitate? What financial moment naturally occurs in their journey that you could make easier?

Maybe your sellers need faster payouts. Maybe your customers abandon checkout because financing feels clunky. Or maybe businesses on your platform wait too long to get paid. Whatever the pain point is, start there.

Interview customers. Study patterns. Map the experience with brutal honesty.

And ask yourself: If we fixed this one moment with embedded finance, how much better would their experience feel?

That’s your value proposition.

Phase 2 – Pilot and Platform Partner Selection

This is the phase where excitement meets reality. You pick a partner, test a small use case, and learn quickly. The goal isn’t perfection—it’s proof.

Choose partners who match your speed, not just your ambition. A great embedded finance enabler will help you run a pilot without overwhelming your team. Your regulated partner will handle the compliance weight, so you can focus on the user experience.

Start with one use case:

-

A simple branded payment method

-

Instant payouts for sellers

-

A buy-now-pay-later option

-

Small working-capital loans for businesses

Run it with a limited audience. Watch how they react. Celebrate the wins and learn from the weird moments—you’ll have a few.

And be honest: Does the pilot solve the real problem you identified in Phase 1?

Phase 3 – Scale, Refine and Integrate Analytics

Once your pilot works, scaling doesn’t mean flipping a switch. It means refining every detail. Embedded finance becomes more powerful when you personalize it—offering the right service to the right customer at the right time.

To scale well, you’ll need:

-

Clean, reliable data

-

A feedback loop from users

-

Clear service-level expectations with partners

-

Ongoing monitoring for fraud, drop-off, and behavior changes

Analytics helps you see the invisible: who is adopting, who is hesitating, and why. It also lets you fine-tune credit offers, payout timing, recommendations, and risk flags.

Scaling isn’t just adding volume. It’s learning—fast and constantly.

So ask yourself: What’s the one insight from the pilot that surprised you, and how does it shape your next move?

Checklist for Readiness: Governance, Operations, Risk, Tech

Before you hit “go,” you need a solid backbone. Not the heavy bureaucratic kind—just clear ownership and reliable processes.

A simple readiness checklist:

-

Governance: Who approves decisions? Who owns risk? Who talks to partners?

-

Operations: What happens when something fails? Who handles escalations?

-

Risk: Do you understand credit, fraud, and compliance responsibilities?

-

Tech: Are APIs stable? Is monitoring live? Can you plug in new features without breaking everything?

If you can answer these confidently, you’re ready for real growth.

And here’s the grounding question: If usage doubled tomorrow, would your systems and team stay calm—or scramble?

The Future of Embedded Finance: What Comes Next

If the last few years felt fast, the next few might feel like a blur. Embedded finance is shifting from a “nice feature” to something that rewires entire industries. And honestly, the companies preparing now—quietly building the rails, the partnerships, the data foundations—are the ones who will set the pace later.

The future isn’t just about money moving faster. It’s about industries blending, ecosystems forming, and non-banks playing roles they never imagined even five years ago.

Verticalised Embedded Finance and Ecosystem Orchestration

We’re moving past generic financial tools and into deeply tailored, industry-specific solutions. A construction software platform offering equipment financing. A healthcare system providing patient payment plans right at intake. A tourism app bundling travel insurance, foreign exchange, and local lending options.

This is verticalised embedded finance—and it’s becoming the new norm. Instead of offering the same payment or credit tool to everyone, platforms will build financial experiences that feel like they were made for one industry, one workflow, sometimes even one customer segment.

The real power comes when these verticals stitch together services across an ecosystem. Imagine being the platform that connects buyers, sellers, suppliers, and lenders in one seamless flow.

Ask yourself: Are we designing for everyone—or building something that truly fits the world our customers live in?

B2B Embedded Finance, Procurement Finance, Supply-Chain Embedded Services

This is where the next wave of growth lives. B2B embedded finance is exploding because businesses feel the pain of slow payments, cash crunches, and choppy procurement cycles every single day.

Think about:

-

A supplier getting paid instantly instead of waiting 45 days

-

A small business accessing credit at the exact moment they need to reorder inventory

-

A freight platform offering cargo insurance or fuel advances right in the workflow

These aren’t “nice-to-have” moments—they’re business survival moments. And non-banks who operate in B2B environments have the advantage of proximity. They see the signals banks miss.

And really, isn’t the most valuable financial offer the one that shows up the second you need it?

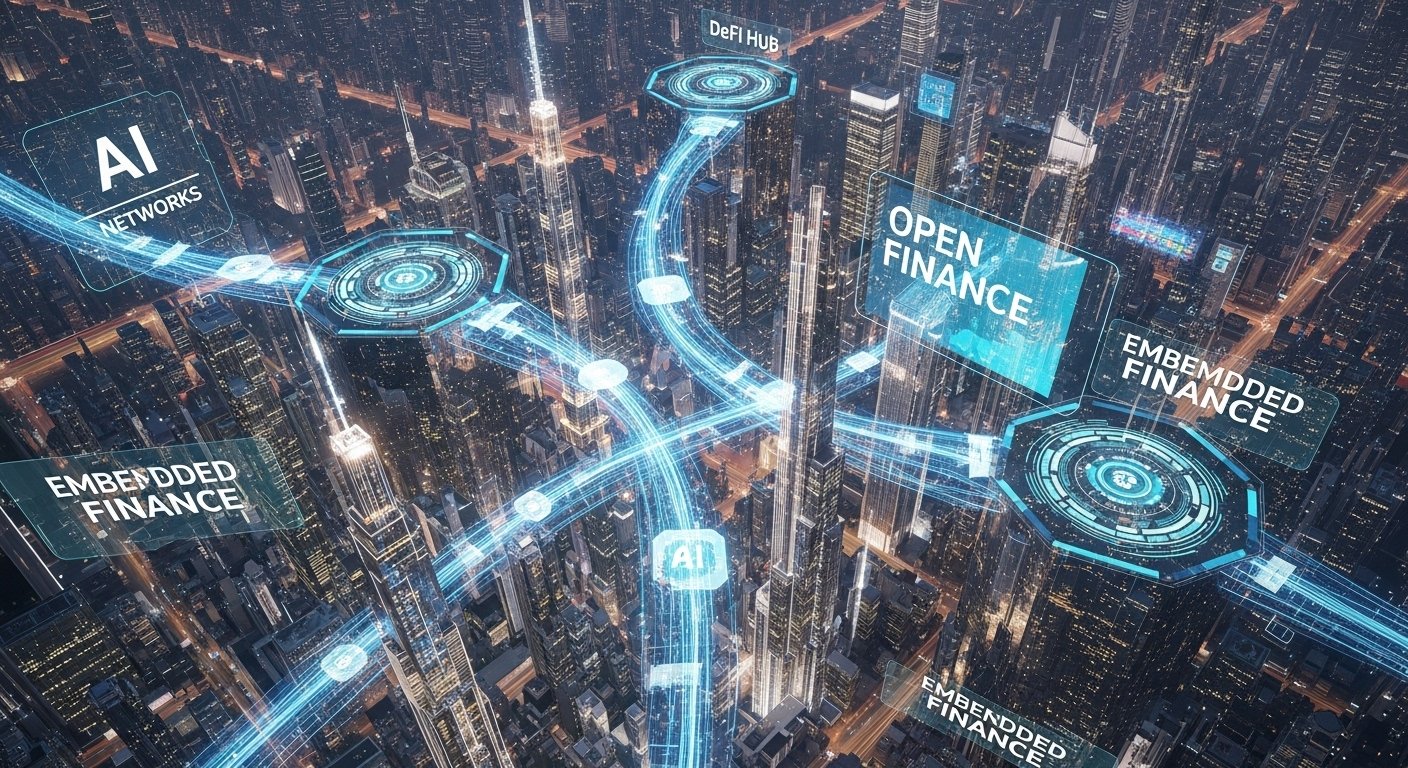

Role of AI, Open Finance, Decentralised Finance in Embedding Future Services

AI is about to make embedded finance feel almost invisible. Not in a creepy way—more in a “this platform just gets me” way. AI will help platforms predict when a business needs financing, when a customer is likely to churn, or when a seller is at risk long before they ask for help.

Open finance will deepen data-sharing in regulated, secure ways, letting non-banks personalize financial offerings with more precision.

And decentralized finance? It won’t replace banks anytime soon, but it will introduce new types of assets, identity tools, and real-time settlement options—especially in regions where traditional banking infrastructure is slow.

The future mix isn’t about choosing between these technologies. It’s about weaving them together in a way that makes financial life simpler.

Ask yourself: If AI could remove your customers’ biggest financial friction points, where would it start?

What Non-Banks Should Prepare for Now

The future doesn’t require you to overhaul everything tomorrow. But it does ask you to get intentional.

Start by building flexible tech—APIs, modular design, real-time data. Strengthen partnerships with banks and fintech enablers who are investing in the same future. Treat data as a strategic asset, not a byproduct. And train your teams to think in terms of long-term customer journeys, not short-term features.

Because at the end of the day, the non-banks that win won’t be the ones with the flashiest features. They’ll be the ones who build trust, understand their customers deeply, and adapt quickly as the landscape shifts.

So here’s the grounding question: If the future arrived a year earlier than expected, would you be ready—or playing catch-up?

Conclusion

It’s funny how the biggest shifts in business often start quietly, almost in the background. Embedded finance has been one of those shifts—slipping into everyday experiences until suddenly it feels impossible to imagine a world without it. And for non-banks, this moment isn’t just about adding a feature. It’s about stepping into a deeper relationship with the people who already trust your platform.

The path isn’t always simple, and there will be decisions that feel heavier than expected. But the opportunity is real, and it’s growing faster than most realize. If you move with intention—listening to your customers, choosing partners wisely, and staying open to what’s coming next—you’ll be in a strong position to shape the future, not just react to it.

Maybe the better question now is this: what’s the first small step you’re ready to take?

FAQs

Q: Why are so many non-bank companies suddenly offering financial features?

A: Most people want everything in one place—paying, borrowing, checking out, you name it. When a platform solves those needs without sending users somewhere else, it builds loyalty. Non-banks are realizing they can support those moments without becoming banks themselves.

Q: Does offering embedded finance mean my company needs a banking license?

A: Not usually. Most non-banks work with licensed partners who handle the regulated parts. Your job is to design the experience and choose partners you trust, not reinvent the entire financial system.

Q: What’s the biggest challenge for a team just starting this journey?

A: Honestly, it’s alignment. Different teams see risk, tech, and customer experience through very different lenses. Getting everyone on the same page early makes the rest of the process far smoother.

Q: How long does it typically take to launch an embedded finance feature?

A: It varies, but many companies roll out a small pilot in a few months. Starting with one simple use case—like payouts or a financing option—helps you learn fast without overwhelming the team.

Q: How do we know if an embedded finance feature is actually working?

A: Look for behavior changes. Faster checkouts, higher engagement, fewer drop-offs, happier customers. Revenue grows over time, but the early signals usually show up in how people use your platform.

Q: Is embedded finance only for e-commerce and fintech companies?

A: Not at all. SaaS platforms, mobility apps, supply-chain systems, and even niche industry tools are finding value in it. If your users handle money, make purchases, or wait for payments, there’s likely room for a financial layer.

Q: What’s the safest way for a non-bank to get started?

A: Start small. Pick one clear problem to solve and partner with a regulated provider who can support you through compliance. You’ll learn more from a focused pilot than months of theoretical planning.